A car is no longer a luxury. The need for this vehicle arises in almost every organization. One needs a truck to deliver products to customers or to stores from a warehouse. The other is a minibus for employees. Still others will be satisfied with a used car for a courier. Well, someone needs an expensive executive car for the director. Situations where no iron horse indispensable, many. Therefore, more and more organizations decide to buy a car. As you know, its cost will be written off as expenses gradually through depreciation. Our article will help you calculate it correctly.A car on the balance sheet gives a lot of trouble to an accountant. Moreover, the problems are not only related to operating costs. Difficulties arise in the calculation of depreciation.

For example, the accountant of almost every company that has bought a car faces a dilemma: is it possible to depreciate a car before it is registered with the traffic police or not?

Another problem is determining the life of the machine. Especially when it comes to a used car.

And, of course, special attention deserves the question of the application of special coefficients. In particular, when depreciating expensive minibuses and cars.

Depreciation and registration in the traffic police

So the company bought the car. Is it necessary to wait for the registration of the car with the traffic police in order to start depreciating it?

Law requirements...

Let's say right away that neither tax nor accounting legislation contains a direct relationship between registration and depreciation.

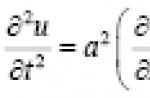

For the purposes of Chapter 25 of the Tax Code of the Russian Federation, depreciation on fixed assets must be charged “from the 1st day of the month following the month in which this object was put into operation” (clause 2, article 259 of the Tax Code of the Russian Federation).

True, paragraph 8 of Article 258 of the Tax Code of the Russian Federation states that fixed assets, the rights to which require state registration, are included in a particular depreciation group only after filing documents for registration. Many car owners mistakenly believe that this rule contains a ban on the depreciation of vehicles before they are registered with the traffic police. I must say that similar explanations were once given by the tax authorities. For example, in the letters of the Federal Tax Service of Russia for Moscow dated May 12, 2004 No. 26-12 / 32341 and December 20, 2002 No. 26-12 / 63114. There are no more recent clarifications from the tax department. But financiers have recently spoken out on this score.

So, according to the Ministry of Finance of Russia, the provisions of paragraph 8 of Article 258 of the Tax Code of the Russian Federation do not at all apply to registering a car with the traffic police. After all, it is not a registration of rights to a vehicle. In fact, this is just registration of the car. That is, it is necessary to start depreciating cars in the generally established order: from the 1st day of the month following the month of commissioning (letter of the Ministry of Finance of Russia dated November 20, 2007 No. 03-03-06 / 1/816).

Registration of a car in the traffic police is not a registration of rights to a vehicle. This means that, according to financiers, it is necessary to start depreciating cars in the generally established order: from the 1st day of the month following the month of commissioningNote that the judges adhere to exactly the same position (see, for example, the decisions of the FAS Northwestern District dated December 25, 2006 No. A05-5787 / 2006-18, FAS of the West Siberian District dated March 23, 2005 No. F04-1621 / 2005 (9589-A27-23)).

As for accounting, here the fixed asset is depreciated “from the first day of the month following the month of acceptance of this object for accounting” (clause 21 PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). The criteria for classifying assets as fixed assets are given in paragraph 4 of PBU 6/01. In particular, it is necessary that the object be intended for use in production. The fact of commissioning does not matter. As the Ministry of Finance of Russia explained in a letter dated April 18, 2007 No. 03-05-06-01 / 33, an object must be taken into account as a fixed asset as soon as it is "brought into a condition suitable for use." As for registration with the traffic police, it is not mentioned in paragraph 4 of PBU 6/01.

…and common sense

It turns out that in order to answer the question of whether it is possible to depreciate a car that is not registered with the traffic police in accounting and tax accounting, it is necessary to decide whether such a vehicle is suitable for use and whether it can be put into operation. There are two points of view on this.

Paragraph 3 of Article 15 of the Federal Law of December 10, 1995 No. 196-FZ “On Road Safety” refers to registration with the traffic police as admitting a car to participate in road traffic. On the basis of this, the tax authorities quite often conclude that before registration with the traffic police, it is too early to talk about putting the car into operation and its suitability for use, and therefore about depreciation. Organizations often prefer to adhere to the same position.

Registration with the traffic police is the admission of a car to participate in road traffic. Therefore, the tax authorities believe that it is premature to talk about putting the car into operation until the moment of registration.However, in our opinion, this is not true. Firstly, five days are allotted for registering a car from the date of purchase, or the time during which the “Transit” sign is valid (clause 3 of the Decree of the Government of the Russian Federation of August 12, 1994 No. 938). It is issued for a period of five to 20 days in the event that the car needs to be driven to the place of registration. That is, at least during the first five days after the acquisition, the company has full right to operate the car. Secondly, even if the company violates the terms, the use of unregistered vehicle would be purely an administrative violation. It shouldn't have any tax implications. And thirdly, the suitability of a car for use, in our opinion, is determined by its technical data, and not by the fact of registration with the traffic police. In this regard, I would like to draw attention to the decision of the Federal Antimonopoly Service of the North Caucasus District dated May 29, 2007 No. F08-1969 / 07-1099A, where the judges indicated that “the commissioning of a car does not depend on the registration of the vehicle.”

Example 1Determine the service lifeSaturn LLC bought a passenger car in March 2008 for 236,000 rubles (including VAT - 36,000 rubles). It was registered with the traffic police only in April. At the same time, registration fees in the amount of 500 rubles were transferred.

LLC "Saturn" put the car into operation in March, without waiting for registration. Monthly depreciation rate for accounting and tax accounting amounted to 2 percent.

The accountant of Saturn LLC made the following entries.

In March 2008:

DEBIT 08 CREDIT 60

200 000 rub. (236,000 - 36,000) - expenses for the purchase of a car are reflected;

DEBIT 19 CREDIT 60

36 000 rub. - VAT included;

DEBIT 68 sub-account "Calculations for VAT" CREDIT 19

36 000 rub. - accepted for VAT deduction;

DEBIT 01 CREDIT 08

200 000 rub. - the car is included in fixed assets.

In April 2008:

DEBIT 68 sub-account "Calculations on state duty" CREDIT 51

500 rub. - the fees for registering a car in the traffic police are listed;

DEBIT 26 CREDIT 68 sub-account "Calculations on state duty"

500 rub. - Duties included.

Monthly since April 2008:

DEBIT 26 CREDIT 02

4000 rub. (200,000 rubles X 2%) - depreciation has been accrued.

In tax accounting in April 2008 (the month following the month when the car was put into operation), Saturn LLC included a 10% depreciation bonus in the amount of 20,000 rubles in other expenses. (200,000 rubles X 10%).

Also, the company attributed depreciation in the amount of 3600 rubles to expenses. ((200,000 rubles - 20,000 rubles) X 2%). The organization will monthly include the same amount (3600 rubles) in the composition of expenses during the depreciation period of the car.

The company wrote off registration fees for the purposes of calculating income tax as other expenses (Subclause 1, Clause 1, Article 264 of the Tax Code of the Russian Federation).

The period during which the company will write off the cost of the car through depreciation is determined by the period of its beneficial use. This period, both in accounting and in tax accounting, is set independently by the company. Moreover, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, firms are required to be guided by the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. The same document can be taken as a basis in accounting.

Depending on the specifications cars (cars and trucks) and buses, in accordance with the Classification, belong to the third, fourth or fifth group. That is, their useful life can vary from three to five years, from five to seven years, or from seven to ten years.

So, for example, cars of higher and big class belong to the fifth depreciation group. This means that organizations can set a service life for them ranging from 85 to 120 months. All other cars (except for small cars for the disabled, which belong to the fourth group) fall into the third depreciation group. This means that their cost can be completely written off within 37-60 months. Minibuses also belong to the third depreciation group.

If a company has purchased a used car, then the useful life determined by the Classification can be reduced by the number of months the car has been used previous owners(clause 12, article 259 of the Tax Code of the Russian Federation). But only on condition of documentary confirmation of the time of service with the former owners.

The useful life of a used car can be determined by taking into account the time of service with previous owners. The period during which the car was operated before you can be found in the vehicle passportIf the previous owner was a company, you can find out how many months the car worked for its benefit from the act of acceptance and transfer of the fixed asset (form No. OS-1). Such data should also be given in the inventory card (form No. OS-6). So, its certified copy may well serve as documentary evidence. In addition, according to financiers, the period during which the car was operated before you can be determined from the data of the vehicle passport (letter of the Ministry of Finance of Russia dated August 3, 2005 No. 03-03-04 / 1/142). These clarifications are especially relevant in relation to cars, among the owners of which were individuals.

However, often the actual service life of a used car turns out to be equal to the maximum useful life provided for in the Classification for the depreciation group to which the car belongs. Or even exceeding it. As stated in paragraph 12 of Article 259 of the Tax Code of the Russian Federation, in this case new owner vehicle can determine the useful life itself "taking into account the requirements of safety and other factors."

Example 2Can this useful life of a used car be less than a year? In our opinion, yes. If the company decides that it will be able to use the car for less than 12 months, its cost can be written off in a lump sum, and not repaid through depreciation. True, it is possible that during the audit the tax authorities will not agree with this approach. Especially if it turns out that in fact the company used this vehicle for more than a year. For example, in the letter of the Federal Tax Service of Russia for Moscow dated August 18, 2004 No. 26-12 / 54016, fiscal officials insisted that the useful life worn out car can't be less than a year.LLC "Jupiter" bought from CJSC "Luna" a middle-class passenger car with an engine displacement of 2 liters. Such vehicles (OKOF code - 15 3410120) belong to the third depreciation group (useful life - from three to five years).

It follows from the acceptance certificate (form No. OS-1) that CJSC Luna used the car for three years and ten months. The organization received it as a contribution to the authorized capital from the founder - individual. From the vehicle passport, it can be seen that the total operating time of the vehicle is five years and seven months. That is, it exceeds maximum term useful life provided for fixed assets included in the third depreciation group.

Considering technical condition vehicle, LLC "Jupiter" decided to set the useful life equal to 24 months.

expensive car

If a company has purchased an expensive car or minibus, it must depreciate them using a special reduction factor. The basic depreciation rate, which is calculated based on the service life of the machine, as determined by the Classification, must be multiplied by 0.5. That is, in fact, the company will write off the cost of the purchase twice as long. After all, as a result of applying the coefficient, the amount of monthly depreciation charges.

It is important to remember that this procedure only applies to tax accounting. RAS 6/01, the use of any reduction factors is not provided.

The use of a coefficient of 0.5 is not a right, but an obligation of the company - the owner passenger car, the initial cost of which exceeds 600,000 rubles, or a minibus worth more than 800,000 rubles (clause 9, article 259 of the Tax Code of the Russian Federation). Note that until 2008, the reduction factor should have been applied to cars more expensive than 300,000 rubles and minibuses worth more than 400,000 rubles.

Due to the increase in limits for all owners expensive transport a logical question arose: is it possible to stop applying the coefficient of 0.5 if the initial cost of a car (minibus) is less than the new values? The financiers answered this question in the negative. In a letter dated January 18, 2008 No. 03-03-06/1/11, the Ministry of Finance of Russia argued its position by saying that "the depreciation method chosen by the taxpayer cannot be changed during the entire period of depreciation."

Financiers believe that the organization should continue to depreciate cars and minibuses, which were considered expensive until 2008, at a reduced rate. Even if now their initial value does not exceed the new limitsIndeed, paragraph 3 of Article 259 of the Tax Code of the Russian Federation contains such a ban. But what does the reduction factor have to do with the depreciation method?

In tax accounting, companies can calculate depreciation in one of two ways: linear or non-linear. Each method provides its own formula for calculating the basic depreciation rate. It is her owners expensive cars must be multiplied by 0.5. If the company stops applying the reduction factor, then the depreciation method will still remain the same (as, indeed, the basic norm). That is, the requirement established by paragraph 3 of Article 259 of the Tax Code of the Russian Federation will not be violated in any way. This means that companies, in our opinion, have every right not to take into account the coefficient of 0.5 from January 2008 when depreciating cars worth from 300,000 to 600,000 rubles and minibuses worth from 400,000 to 800,000 rubles.

The mentioned letter of the Ministry of Finance of Russia is a response to a private request. Firms are not bound by these clarifications. However, it is possible that they will be adopted by the tax authorities. In this case, companies that have refused to apply the reduction factor, most likely, will have to defend their position in court.

Example 3In 2007, Mercury LLC bought a minibus, the initial cost of which was 750,000 rubles. The useful life of the machine in both tax and accounting records is set at 40 months. Depreciation is calculated using the straight line method. The basic depreciation rate was 2.5% (1:40 X 100%).

Since the minibus costs more than 400,000 rubles, in 2007 Mercury LLC had to depreciate this fixed asset, taking into account the reduction factor. The company's accounting policy provides for the use of a depreciation bonus of 10 percent capital investments. Thus, the monthly amount of tax depreciation deductions in 2007 was:

(750,000 rubles - 750,000 rubles X 10%) X 2.5% X 0.5 \u003d 8437 rubles. 50 kop.

In accounting during 2007, the accountant of Mercury LLC monthly charged depreciation in the amount of:

RUB 750,000 X 2.5% = 18,750 rubles.

In 2008, the organization decided not to apply the reduction factor. Indeed, now the initial cost of a minibus no longer exceeds the limit established by the code (750,000 rubles).< 800 000 руб.). Начиная с января, сумма ежемесячных амортизационных отчислений для целей налогового учета равна:

(750,000 rubles - 750,000 rubles X 10%) X 2.5% \u003d 16,875 rubles.

In accounting, the company will continue to charge depreciation in the amount of 18,750 rubles per month.

Determining the useful life of a car of any kind, whether it be a passenger car, truck or bus, depends on its technical characteristics. Most of them can be obtained by analyzing the vehicle passport, or based on the model description specified in the appendix to the purchase agreement or in the operation manual. This article discusses how to determine the depreciation group and useful life passenger car car.

"Engine to the stage!"

In most cases car depreciation group depends on its class. At car models only 5 classes, with the first four depending on the engine size. The working volume of the engine is given in column 11 of the vehicle passport, and based on it, you can determine whether the car belongs to a particularly small, small, medium or large class.

Passenger car refers to:

1st - especially small class, if the working volume of its engine does not exceed 1.2 liters,

to the 2nd - small class - if the engine size is in the range of more than 1.2 to 1.8 liters

to the 3rd middle class - if the engine capacity exceeds 1.8 liters, but not more than 3.5 liters.

4th - large class - if the engine size is over 3.5 liters.

The useful life of a class 1-3 passenger car is from 3 to 5 years (depreciation group 3).

But if a passenger car of a small class is intended for a disabled person, then its place is already in the 4th depreciation group and its useful life will already be in the range of over 5 and up to 7 years.

Large and premium passenger cars are depreciated even longer, from 7 to 10 years. They are included in the 5th depreciation group.

What is the highest class of a passenger car?

For passenger cars of the highest - fifth class, the engine size does not matter, and a passenger car, even with a small engine size, can refer to upper class. It should be noted that there are no criteria for classifying cars as the highest class in regulatory documents. Moscow tax officials propose to classify executive cars as the highest class. True, the concept of a representative car is also subjective, because it is proposed to rely on such vague criteria as brand reputation, price, dimensions, engine power, manufacturing according to special order, the presence of an armored body, speed, body shape (sedan, limousine), comfort, availability of additional equipment.

The only guideline for determining the class of a passenger car domestic car can be the first digit in an alphabetic — digital designation vehicle model (column 2 "Model, brand of vehicle" in the TCP).

For example,

UAZ Hunter Welcome 3 15195-162-01 is a passenger car of the 3rd (middle) class. ZIL 4 1047 - belongs to the 4th class of passenger cars (its engine capacity is 5.4 liters)

In cars domestic production the highest class will be indicated by the first digit 5 in its model number.

Since foreign cars do not have a similar type designation, class in the brand name, then to prevent a dispute about the correctness of determining the useful life of cars foreign production, engine capacity, which is less than 3.5 liters, it is advisable to obtain a written opinion from the manufacturing plant (its representative office in Russia) about its belonging to a representative (higher) or other class.

The entire cost of a vehicle purchased by an enterprise is never written off immediately. It is deducted gradually over the useful life. It is necessary to consider the depreciation of a car in the framework of accounting and tax accounting.

Depreciation of a car is a write-off of the cost of a vehicle in parts in accordance with physical wear and tear. In other words, if the car was purchased by the enterprise, then its cost is not written off by the accounting department immediately, but gradually over several years.

Depreciation deductions relate to the costs of the enterprise. They are deducted from fixed assets (PBU 6/01 of 03/30/2001). This is the cash equivalent of wear and tear.

- the company buys a car;

- the company hires an employee with a car.

Car rental can be recorded on account 01, which reflects information about fixed assets in operation. But only if this asset generates income for more than 12 months in a row.

Depreciation is used in accounting and tax accounting. It is needed to gradually write off the amounts of large expenses so as not to create negative indicators in a short period.

Calculation in accounting

The calculation algorithm is as follows:

- determine the useful life;

- select a calculation method (the direct method is more often used and by the sum of the numbers of the useful life, it can also be calculated with a decrease in the balance or on the basis of machine hours);

- reflect the chosen method in the accounting policy;

- make calculations, apply the chosen method throughout the useful life.

Changing the calculation method is not allowed for an object.

When it is worth starting to write off deductions depends on the period of putting the vehicle into operation, and not the fact of its purchase. It also does not matter when the car was registered with the traffic police.

There are several ways to calculate car depreciation. The basis is the cost of the car without VAT, reflected in the debit of the account. No. 1 "Fixed assets". The money written off is indicated on the credit of account 02 "Depreciation of fixed assets".

The useful life can be peeped in Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. Cars fall into the 3rd group (3-5 years), 4th (5-7 years), 5th (7-10 years).

For calculations, you can use the directory, which shows the book value of the vehicle model. The resulting value is divided by the period of use and the amount of depreciation is obtained. No single directory, on which all calculations would line up. It is allowed to take nomenclature catalogs published by specialized organizations as a basis.

In accounting, two methods are most often used - a linear method and a method based on the sum of useful life numbers. Which of them to apply, chooses the company itself. However, you can stop at a certain option before the commissioning of the accounting object. And you can't change it later.

Line method example

Assumes a uniform write-off of funds over the entire period of depreciation.

For example, the new Ford Transit basic configuration net of VAT costs 1,685 thousand rubles. It is assumed that the enterprise will use it for 5 years (60 months). In this case, the monthly depreciation amount is 28.08 thousand rubles. (337 thousand rubles per year). Total depreciation for each year will be 20%.

For an accurate calculation of deductions taking into account depreciation, it is necessary to take into account the mileage since the beginning of operation, climatic conditions, locality in which the vehicle is to be used, the ecological state of the region. Also important is the brand and country of manufacture of the machine. The quality of the assembly determines how much maintenance and service costs will cost.

An example of a method based on the sum of useful life numbers

Calculation based on the above data of the cost of the car (1,685 thousand rubles). without taking into account the cost of maintaining and servicing the vehicle.

5 years of car operation = 1+2+3+4+5 = 15

First, the serial number of the year of operation is added up: first (1), second (2), third (3), fourth (4), fifth (5), sixth (6). It turns out 15. Then, in the first year of operation, deductions are calculated as follows:

AO \u003d ordinal year (from the end) ÷ the sum of the ordinal numbers of years x the cost of the car

T. arr. in the first year, the largest amount is written off, in the last - the smallest.

Depreciation in tax accounting

In tax accounting, a linear and non-linear method is used. With the straight-line method, the amount of annual depreciation is 337 thousand rubles. (1685 ÷ 60). Nonlinear is described in Art. 259.2 of the Tax Code of the Russian Federation.

In tax accounting at the beginning of the reporting period, the organization has the right to change the method of calculation. However, if the non-linear method was initially chosen, then the linear method can be used no earlier than after 5 years.

accelerated depreciation

This is one of the types of depreciation, in which the calculation of depreciation takes place with a multiplying factor - 2 or 3 (Article 259.3 of the Tax Code of the Russian Federation). Can be applied if the car is leased.

Many firms have cars or cars on their balance sheets. passenger minibuses. Let's figure out what is the peculiarity of their depreciation in tax and accounting. How to avoid possible differences between accounts and thus simplify the work of an accountant.

Both in accounting (clause 4 of PBU 6/01, approved by order of the Ministry of Finance dated March 30, 2001 No. 26n), and in tax accounting (clause 1 of article 257 of the Tax Code), a car is recognized as a fixed asset. Its cost is paid off through depreciation. At linear way The annual depreciation amount is calculated based on the initial cost of the fixed asset, useful life and depreciation rate.

Determine the useful life

When accepting a car for accounting, the company sets its useful life on its own. To do this, determine the expected time of using the car, based on its performance and power (clause 20 PBU 6/01). The possible period of use can also be affected, for example, by the mode and operating conditions.

In tax accounting, the term of use is also set by the company itself, but it must take into account the terms specified in the Classification of fixed assets approved by Government Decree No. 1 of January 1, 2002. To do this, it is necessary to determine which depreciation group the car belongs to (clause 3 of Art. 258 NK). Then establish a specific period of its useful life within the terms specified for this depreciation group.

Calculate the depreciation rate

If in accounting we determine the period of use of the car, for example, 48 months, then the depreciation rate for accounting will be 2.1 percent (100%: 48 months) per month (clause 19 PBU 6/01). Car depreciation is charged starting from the 1st day of the month following the month of acceptance of the object for accounting, and is carried out until the cost is fully repaid or written off (clause 21 PBU 6/01).

If the same period for using the car is determined in tax accounting, then the monthly depreciation rate for tax accounting purposes (clause 4, article 259 of the Tax Code) will be 2.1 percent (1: 48 months x 100%) and will be equal to the rate calculated according to accounting rules. Depreciation starts on the first day of the month following the month in which the car was put into operation (clause 2, article 259 of the Tax Code).

The Tax Code separately allocates expensive cars (clause 9 of article 259 of the Tax Code). He includes cars or minibuses with an initial cost of more than 300 and 400 thousand rubles, respectively. The depreciation rate for such vehicles must be applied with a special coefficient of 0.5.

The procedure for calculating the monthly depreciation rate (for the straight-line method) is as follows: the unit is divided by the useful life in months, and the result is multiplied by 100 percent and by a correction factor of 0.5 (letter of the Federal Tax Service for Moscow dated February 17, 2005 No. 20 -12/10061). It turns out that for the period of use of vehicles - 48 months, the depreciation rate will be 1.05 percent.

In accounting, there is no such rule and, unlike the tax one, a reduction coefficient cannot be applied (letter of the Ministry of Finance dated October 21, 2003 No. 16-00-14 / 318).

It turns out that by setting in both accounts the same term use of an expensive car, the firm will actually write it off for tax purposes twice as long. This is possible, since the Tax Code indicates that depreciation on a fixed asset is terminated only if “the initial cost is fully written off or the object is removed from the depreciated property” (clause 2 of article 259 of the Tax Code).

Due to the reduction factor, the monthly depreciation amount in tax accounting will be two times less than in accounting. This will lead to a difference that will have to be taken into account in accordance with the rules of PBU 18/02 “Accounting for income tax settlements” (approved by order of the Ministry of Finance dated November 19, 2002 No. 114n).

Example

The company has on its balance sheet a passenger car with an initial cost of 480,000 rubles. For simplicity, let's assume that this cost is the same for both accounts.

In accordance with the Classification of Fixed Assets (approved by Government Decree No. 1 of January 1, 2002), cars with an engine capacity of up to 3.5 liters are assigned to the third depreciation group. The useful life of such property is from 3 to 5 years inclusive (from 36 to 60 months). Code according to the Classifier - 15 3410010.

The director of the company, both for accounting and for tax accounting, set the period of use of the car - 48 months.

Then for accounting the depreciation rate will be 2.1 percent and monthly it will be possible to write off 10,000 rubles.

For tax accounting purposes, due to the adjustment factor of 0.5, the depreciation rate will be 1.05 percent. As an expense for depreciation, the company will be able to accept only 5,000 rubles. per month.

The amount of expenses that can be taken into account when calculating income tax is 5,000 rubles. less than the amount recognized in accounting. A deductible temporary difference is formed, which leads to the emergence of deferred income tax (subclauses 11, 14 PBU 18/02).

During the first four years, the accountant records:

Debit 09 Credit 68

- 14,400 rubles. (60,000 rubles x 24%) - reflects a deferred tax asset.

Over the next four years, the deductible temporary difference will be canceled and a reverse posting will need to be made. This is due to the fact that in tax accounting depreciation will continue to be charged on this car, while in accounting it will already be depreciated.

Debit 68 Credit 09

- 14,400 rubles. - the deferred tax asset is settled.

As a result, there is no balance on account 09.

Year of depreciation Amount of depreciation in accounting Amount of depreciation in tax accounting Temporary difference (column 2 - colum 3) Deferred tax asset (y. 3 x 24%) 1 2 3 4 5 1st year 120 000 60 000 60 000 14 400 2nd year 120 000 60 000 60 000 14 400 3rd year 120 000 60 000 60 000 14 400 4th year 120 000 60 000 60 000 14 400 5th year – 60 000 -60 000 -14 400 6th year – 60 000 -60 000 -14 400 7th year – 60 000 -60 000 -14 400 8th year – 60 000 -60 000 -14 400

Making life easier for an accountant

To bring together tax and accounting data, a company can set in accounting for expensive cars more long term beneficial use. Just do not forget to indicate this decision in the accounting policy.

If the term is doubled, then the amount of monthly depreciation for accounting purposes will coincide with the monthly amount of depreciation for tax accounting purposes. Then it will not be necessary to apply PBU 18/02 “Accounting for income tax settlements”.

It should be noted that the proposed option, on the one hand, simplifies accounting and tax accounting (the amount of depreciation will be the same), but, on the other hand, leads to an overestimation of property tax. After all, the basis for this tax is determined according to accounting data (clause 1, article 374 of the Tax Code).

There is one more "but". Since 2006, the company can exercise the right to a depreciation premium (clause 1.1 of article 259 of the Tax Code). This means that in tax accounting, up to 10 percent of the value of the acquired fixed asset put into operation can be written off as expenses at a time. Accounting rules do not provide for this.

In this case, no increase in the useful life of the car in accounting will make the amount of depreciation and accounting according to PBU 18/02 the same for the accountant.

The car was upgraded

A situation is possible when the initial cost of a company car does not exceed 300 thousand rubles. However, later the company decides to modernize it, for example, to install an air conditioner.

In tax accounting, the initial cost of a car increases as a result of modernization (clause 2, article 257 of the Tax Code). If it becomes higher than the cherished three hundred thousand, then from the first day of the month following the month of completion of such modernization, the company will have to halve the depreciation rate.

By the way, in accounting, modernization also increases the initial cost of fixed assets (clause 14 PBU 6/01, approved by order of the Ministry of Finance dated March 30, 2001 No. 26n).

Voluntary odds

In tax accounting, in addition to the mandatory reduction coefficient, there are voluntary coefficients. The firm decides whether to use them or not. She reflects her decision in the accounting policy.

If the car operates in an aggressive environment or increased shifts, then the company can apply a multiplying factor to the depreciation rate - no higher than 2 (clause 7, article 259 of the Tax Code). For example, if the car is actually used for more than two work shifts (letter of the UMNS for Moscow dated October 2, 2003 No. 26-12 / 54400).

The firm also has the right to apply lower depreciation rates than provided for in articles 258 and 259 of the Tax Code. And this decision should be fixed in the accounting policy for tax purposes.

T. Bursulaia, Senior Auditor, Gradient Alfa Group of Companies Material source -

Answer

Passenger cars belong to depreciation groups depending on their type.

Most of the cars belong to the 3rd depreciation group of fixed assets (the useful life is over 3 and up to 5 years).

At the same time, some types of passenger cars, for example, Cars of a large class, Cars of a higher class, belong to the 4th or 5th depreciation groups.

Rationale

Passenger cars (OKOF code 310.29.10.2).

Vehicles for transporting people, other vehicles (small class cars for the disabled, OKOF code 310.29.10.24)

Vehicles for the transportation of people, other passenger cars of a large class ((with an engine capacity of more than 3.5 liters) and a higher class, OKOF code 310.29.10.24).

Until 01.01.2017

The 3rd depreciation group of fixed assets includes (useful life over 3 and up to 5 years):

Passenger cars ( 15 3410010, except for 15 3410114, 15 3410130 - 15 3410141).

Thus, in general case, a passenger car belongs to the 3rd depreciation group.

The exception is:

Cars of a small class for the disabled ( 15 3410114) - such cars belong to the 4th depreciation group (property with a useful life of more than 5 years up to 7 years inclusive).

Cars of a large class (with an engine capacity of more than 3.5 liters) - ( 15 3410130) - such cars belong to the 5th depreciation group (property with a useful life of more than 7 years to 10 years inclusive).

Cars of a large class for individual and official use- ( 15 3410131) - belong to the 5th depreciation group (property with a useful life of more than 7 years up to 10 years inclusive).

Cars of the highest class - ( 15 3410140) - belong to the 5th depreciation group (property with a useful life of more than 7 years to 10 years inclusive).

Cars of the highest class for official use - ( 15 3410141) - belong to the 5th depreciation group (property with a useful life of more than 7 years up to 10 years inclusive).

What types of cars are classified as luxury cars?

Regulations apply this concept (for example,), but do not define its meaning. In the Letter of the Federal Tax Service of the Russian Federation for Moscow dated December 21, 2011 N 16-15 / [email protected] the absence of the meaning of the term "cars of the highest class" is indicated and it is recommended to apply the Letter of the State Customs Committee of Russia dated February 26, 1997 N 04-30 / 3515 "On the classification vehicles". At the same time, the last letter does not contain clear criteria for assigning cars to one class or another. It only indicates the signs that must be taken into account in this case.

In my opinion, in the absence of a clear regulatory framework, you can use the international classification of cars. There are six in total classes A,B,C,D,E, F. Of these, class F ("luxury", " executive class"):

Mini class (A) - small cars, no more than 3.6 m long and no more than 1.6 m wide.

Small class (B) - small cars with a length of 3.6 - 3.9 m, a width of 1.5 - 1.7 m.

Lower middle class(WITH). Vehicle length 3.9 - 4.4 m, width - 1.6-1.75 m.