The most popular credit institution in Russia is Sberbank. It has a wide network of representative offices, branches, self-service devices and other points of presence. With its help, not only loans issued by the financial company itself, but also from third-party banks are serviced.

OTP Bank borrowers who simultaneously have a Sberbank card can repay loans through the services of this credit institution. It is possible to repay the debt through Sberbank Online or its mobile application, in self-service devices. Through the company's website, borrowers who are not even Sberbank customers can repay a loan.

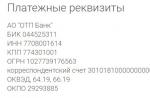

To carry out the operation, the borrower must prepare a loan agreement, it contains an account for transferring funds to pay off the debt and details of OTP Bank:

The guide for using Sberbank online provides for the possibility for users to repay loans from other banks through the service of a credit institution:

With the help of Internet banking, repayment is carried out through the company's website, its mobile application. Additionally, the client can configure the auto payment option.

Via website

The operation consists of several stages:

The number of the card account from which the payment will be made is entered, if only one account is linked to the card, it will be automatically entered in the document. The account number to which the money is transferred should be taken from the loan agreement. You will need to enter your full name. borrower, payer, his address.

- Enter the payer's phone number, amount.

- To carry out the operation, you will need to confirm it with a one-time password.

- After the payment is completed, the system will offer to save or print a receipt, create a template, or enable the auto payment function.

The bank regulates the term for crediting funds - 3 business days.

Via mobile app

You can repay a loan from OTP Bank using a mobile application. This is the most common way, because you can make a payment at any time convenient for the client.

Actions will be as follows:

Auto payment service

Using auto payment is convenient if the payer regularly repays the loan from the Sberbank card.

After the operation is completed, the system will offer the payer to activate the "Auto payment" option. By clicking on the appropriate field, the system will automatically remember the details, date and amount of the transaction. The day before the due date, the user will receive a notification that the loan is due. If you do not need to pay the debt, the operation can be canceled. Otherwise, on the appointed day, the amount will be debited from the client's account to repay the loan.

The operation will be available only if there is a sufficient amount of funds on the account.

Payment by Sberbank card

Cardholders of a credit institution can repay a loan from a third-party bank through an ATM or use funds transfers between accounts on the OTP Bank website.

Through an ATM or terminal

Not all Sberbank cardholders are connected to the Internet banking system, but they can also pay off the debt using an ATM.

The user must do the following:

Through the website of OTP Bank

The credit institution offers its borrowers to pay the loan on the website with a Sberbank card:

The operation is carried out through the Golden Crown payment service. To make a payment, you must fill out the payment form and write the amount. After checking and confirming the information, the details of the card account from which the money will be debited are entered. A one-time password will be sent to the payer's phone, after entering it, the payment will be made.

You can make transactions with PS MIR, Visa, Mastercard, Maestro cards that support Accept, Verified by Visa and Mastercard SecureCode technology.

If you have an Internet connection, the money is credited to the account within a few minutes; according to the regulations, the crediting period is 1-3 days.

Commission amount

Paying a loan with a card of a third-party bank is a paid service. The amount of the commission depends on the payment method:

- When paying through Sberbank online, its ATMs and terminals, the commission will be 1%;

- When a loan is paid through the OTP Bank website with a Sberbank card, the fee is 2%.

The maximum transfer amount is 15 thousand rubles.

OTP Bank issues consumer, commodity and mortgage loans to individuals with a positive credit history with a minimum set of documents and the personal presence of the borrower. A loan for goods is issued directly in a household appliances or electronics store, the money is not issued in cash, but transferred for the purchase to the settlement account of the bank's partner store. From the moment the purchase is made, the buyer becomes a client of the bank and must address all issues related to the loan to the bank or to the consultant representative of the bank in the trading network.

After receiving a loan, the question arises of how to repay the loan in OTP Bank in full or how to make the first mandatory payment. For the convenience of customers, the organization provides several options for repaying a loan via the Internet and in cash.

The fastest way, online payment from a card of another bank of the Russian Federation on the page https://www.otpbank.ru/retail/canalplateg/.

Transfer fee - 2% of the payment amount. For example, this is how you can repay a loan at OTP Bank through Sberbank online or Alfa Bank cards.

If you want to pay a loan in OTP Bank in cash, use an ATM or the services of partner organizations of OTP Bank. Below is a table with information about the commission.

Regardless of the organization chosen, with the exception of OTP Bank terminals, the money to repay the loan will be credited only on the next business day after the deposit. You will have to look for where you can repay the loan and deposit money in advance.

In order not to pay a commission for paying a consumer loan, use OTP Bank ATMs or make a payment through the Unistream money transfer system.

You can make payments at any branch of OTP Bank in Russia through a cash desk (you will need a passport) or a self-service terminal (you need to know the details specified in the loan agreement).

How to partially repay a loan in OTP Bank ahead of schedule or in full?

In order to early repay a commodity loan at OTP Bank, you must:

- Contact the OTP Bank support service and find out the exact amount of the loan balance;

- Fully deposit the required amount into the account;

- On the due date of the next payment, the loan will be repaid. You do not need to come to a store or bank office to write an application;

- To make sure that the loan has been repaid in full, contact the bank's support service again or check the status of the loan through the Internet bank.

To repay a loan that you received in cash from a bank, you must write an application for early repayment of the loan at the office, KCO or at a point of sale and deposit the amount to be repaid into the account. In case of partial early repayment, interest will be recalculated and you will receive a new payment schedule.

Where can I get loan information?

If you have lost the details for paying a loan at the OTP bank, want to know the date and amount of the monthly payment, or find out the total debt to the bank, you can contact the bank branch, the contact center support service, or view the information you are interested in through the OTPdirect Internet bank. The Bank's Help Desk is open 24/7.

What happens if you do not pay a loan in OTP Bank?

If you cannot make the next payment on the loan at OTP Bank due to deteriorating financial situation and temporary difficulties, contact the bank for loan restructuring with an increase in the deadline for the loan, or reschedule the date of the monthly payment. Restructuring also involves the possible suspension of loan payments for a certain period.

Once a loan is issued, the main task of the borrower is to comply with the terms of its repayment. Of the many payment methods, everyone can choose the most convenient. For owners of Sberbank card products, information on how to pay a loan at OTP Bank through. A complete guide and step-by-step instructions are clear even to an inexperienced user.

The first step is to access the service, which is done by entering a user ID and password. You can get them in two ways:

- print at a Sberbank ATM;

- register in the personal account of Sberbank.

To register, you will need a card and a mobile phone number to which it is linked. An SMS will be sent to him with a password to enter the system. After receiving the necessary data, you can proceed to payment. A step-by-step guide will help you figure out how to pay through Sberbank online.

For the transfer, the bank charges a minimum commission, only 1%. Money can be credited both immediately after payment, and on the 3rd day, because the term for crediting is 1-3 working days.

There are several ways to make a payment through the system.:

- according to the details of the organization;

- by account number;

- by card transfer.

Let's consider each of them in more detail.

Payment by details

For this method, the details of the organization will be required. You can find them in the loan agreement. The payment instruction consists of the following steps:

This method is not good enough, because it does not allow you to pay for a loan with a Sberbank credit card.

Payment by account number

In Sberbank Online, paying for an OTP bank loan is the easiest way. It differs slightly from the one described above. Steps 1 to 3 are repeated, after which you must perform the following steps:

Transfer to an OTP bank card

The method will be appreciated by the owners of debit or credit cards from the bank. To make a payment after authorization in the system and going to the "Transfers and payments" tab, you need to perform the following steps:

- Select "Transfer to a card in another bank".

- Indicate the card number indicated on the front side. Select the debit account and payment amount.

- Confirm payment.

Pay off an OTP bank loan through the Sberbank Online application

You can also make payments on a loan through a mobile application. To do this, you need to download and install it on your smartphone. The application is free and available in the AppStore and Google Play. It requires an internet connection to work. After the first launch, you must specify the login information (login, password) and come up with an additional code consisting of 5 digits. On subsequent launches, you will only need to enter it.

You can repay an OTP bank loan using the application: by transferring money to an OTP account or card. To replenish your OTP account, follow these steps:

- go to the application;

- go to the "Payments" tab;

- select "To an account in another bank";

- enter account number;

- organization transfer;

- indicate the TIN and BIC;

- enter the amount and confirm the transaction.

In the Sberbank Online mobile application, you can pay a loan by transferring to a card as follows: enter the application - the "Payments" tab - To a card to another bank - By card number - enter the card number - payment amount - confirmation.

Be careful when paying through the app. All operations are confirmed by pressing the corresponding button, SMS with a confirmation code does not come.

Pay a loan from OTP Bank in a mobile application using the details

Can. This is done as follows:

- Application launch.

- Tab "Payments".

- "Other" button.

- In the search line, enter the BIC or TIN of the credit institution.

- All required fields are filled in, the amount and account to be debited are indicated.

After applying for a loan, it is best to repay the loan using the "Auto payment" service. You can connect it both on the website and in the mobile application of Sberbank. With this service, if you have funds in your account, you do not have to worry about timely payment. To activate the "Auto payment" service, do the following:

- start the application;

- go to the second tab "Payments";

- select "Auto payments";

- in the search line, type the BIC or TIN of the credit institution;

- indicate the account number, full name and address of the OTP client, full name of the payer, the card from which the funds will be debited;

- set the payment frequency, debit date and amount;

- Check if the data entered is correct and then confirm.

Auto payment created. Payment will be debited monthly without the participation of the borrower.

In order to reduce interest costs, many are interested in how to repay a loan early in OTP Bank via the Internet.

OTP loans are very popular among the population, one of their advantages is the absence of commissions and penalties for early repayment of the debt.

The conditions for early repayment of a loan or installment plan are very loyal to the borrower:

- The minimum amount is not set, you can return only 200 rubles. and the bank representative will make changes to the schedule;

- There is no minimum period for using credit funds, you can return it even on the second day of lending;

- There are no commissions, fines and penalties for returning money earlier than the scheduled date;

- Reducing the loan is carried out by depositing money into an account opened earlier and further debiting;

- Funds are debited exclusively on a working day (replenishment on Saturday / Sunday, then funds will be debited no earlier than Monday);

- Money on account of the complete closure of the contract, the money is debited on the planned payment date (the application is optional);

- For a partial refund, you need to write an application (preferably 2 days before the date of debiting), the amount to be debited must be indicated;

- First, the delay is debited from the account, then the current interest, payment according to the schedule, and the balance can be directed to additional repayment;

- It is important to deposit funds to the current ruble account in advance, taking into account the required period for crediting money;

- You can pay the debt ahead of schedule through any available channel; transfer of funds without restrictions;

- With full repayment, you must take into account the commission of an intermediary for transferring money.

How to find out the amount for early repayment of a loan in OTP Bank

To protect yourself from paying additional interest, you need to properly pay off the debt, the main thing is to determine the amount of the payment:

- The amount for the full closure of the loan is the balance of the principal loan plus interest that will be accrued before the write-off date according to the established schedule. If there is less money on your account (even by a few kopecks), then only the planned payment will be debited and the loan will not be closed.

- The amount of partial early repayment is what is written in the application. It is important that after the mandatory payments are written off, it remains in full, otherwise a delay may occur. The consequence of a partial refund is a change in the payment schedule.

If you need to pay off a credit card, then you also need to know the amount to completely close the limit.

The amount you need to pay can be found in the following ways:

- Through a personal account on the website www.otpbank.ru;

- Through the mobile application "OTPdirect";

- At a branch of a banking organization;

- By calling the hotline: cash loan - 8 800 100 5555, consumer - 8 800 200 7005; credit card - 8 800 200 7001.

How to repay a loan early in OTP Bank: online instructions

How to close a loan ahead of schedule in OTP Bank:

- Find out the amount for a full refund (taking into account future interest, commission costs for money transfer);

- Deposit it in advance to the current account opened during the transaction:

- Through Internet services: OTPcredit, Zolotaya Korona, QIWI, YandexMoney; Eleksnet,

- Pay with a Sberbank card,

- Deposit cash at the terminal, bank or post office;

- You can warn the bank about your intention to pay off the debt in full;

- Expect the planned date and reduce the loan;

- Check if the contract is closed.

How to repay a loan in OTP Bank partially:

- Find out the amount of the planned payment;

- Deposit money to your account: via the Internet, terminal, branch, Qiwi wallet or any other convenient way;

- Apply to the branch with the following information:

- Desired refund amount (only the planned payment can be debited automatically),

- Option to change the schedule: reduce the loan term or monthly payment;

- You are waiting for the payment to be written off and the schedule to be recalculated;

- Get a new chart.

Checking if we owe the bank

After writing off a certain amount or full repayment, the client should receive an SMS message (provided that the service is connected).

If there is no message, then it is necessary to clarify the information with a bank representative. Perhaps the debt was not repaid for one of the reasons: there was not enough money (the intermediary wrote off an additional commission) or they were not credited to the current account on time.

- Online through the OTPdirect service;

- By calling the operator;

- By contacting the branch, where you can also order

Every year, Russians are increasingly making mandatory payments online, using their existing card accounts for this purpose. One of the most popular Internet services provided by domestic financial institutions is online loan repayment, and OTP Bank is no exception in this case.

OTP Bank provides the opportunity to pay a loan online to all its borrowers, without exception, provided that they have an account with a positive balance, including one opened with a third-party financial institution.

Apply for consumer loans up to 5,000,000 rublesPay a loan online OTP Bank - is it possible without commissions

OTP Bank offers its borrowers to pay for a loan online through OTP Direct Internet banking and special mobile applications.

One of them - "Credit Assistant" - allows clients of a financial institution to pay debt on a retail loan from a mobile account. The second - "Mobile Bank" - makes it possible for OTP borrowers to pay a loan online from debit cards and current accounts opened in the organization. In this case, the client is not charged for the operation.

Through the Internet bank OTP, payment of the loan online is carried out in the shortest possible time, but the borrower still needs to transfer funds in advance - a few days before the deadline.

Repay the loan: payment via the Internet using the contract/account number

OTP customers can pay a loan online using the contract number without commissions only on the website of the lender directly. To do this, they must first register with OTP Direct and log in using the assigned login and password. For OTP borrowers, repaying a loan online through Internet banking is very convenient due to the absence of commissions, quick transfer of funds and the ability to check the balance of the debt and the amount of the monthly payment.

If the client does not have a debit account with this financial institution, he is offered the opportunity to pay for a loan at OTP Bank via the Internet with a card from Sberbank or any other organization. In the latter case, borrowers have access to both the services of their payroll banks and third-party financial institutions. For example, in OTP online, you can repay a loan on a card using the transfer service from Alfa-Bank. The commission in this case will be 1.95%, at least 30 rubles.

Borrowers who have QIWI and Yandex.Money e-wallets can pay the loan online at OTP Bank with their help. The second payment system is also ready to act as an intermediary when transferring funds from the client's bank card to his OTP account when repaying a loan online.

The commission for OTP Bank borrowers when paying for a loan online through the QIWI and Yandex.Money systems is 1.6% (from 100 rubles) and 3% (+15 rubles), respectively.

How to pay a loan to OTP Bank through Sberbank online

Considering the abundance of “salary” clients of the Security Council of the Russian Federation, it is not surprising that many Russians are asking the question: “Is it possible to pay off an OTP Bank loan through Sberbank Online?”. And such a service is really available to any owner of a settlement or card account of the Security Council of the Russian Federation.

Before paying a loan from OTP Bank through Sberbank Online, the user must log in to the system. This is preceded by registration in the Internet Bank, during which you should choose a login and password, confirming access with an SMS password.

Before paying a loan to OTP Bank through Sberbank Online, the user must take into account the fact that this service is not free. The fee for repaying an OTP Bank loan through Sberbank Online is 1% of the payment amount.

Debt repayment at OTP Bank: pay for a loan with a card of the Security Council of the Russian Federation

Before using Sberbank Online to pay for a loan from OTP Bank, owners of payment cards of the Security Council of the Russian Federation must rewrite the details of the latter from their agreement. Then, having logged in on the website of the Security Council of the Russian Federation, the user enters the "Transfers and payments" menu, the "Repayment of a loan from other banks" subsection.

Payment for an OTP Bank loan through Sberbank Online is made on the "Loan repayment by BIC" tab. The user indicates the code of his creditor (044525311) and the number of the loan account (20 digits). Then he fills in the field with the payment amount and confirms the operation.

Before repaying a loan at OTP Bank through Sberbank Online, the borrower should save the transaction template. Based on it, you can also set up the "Autopayment" service, while monitoring the operation on a monthly basis using SMS notifications.

Placement date: 08.10.2017